Revolut: plans, cards and opinions 2023

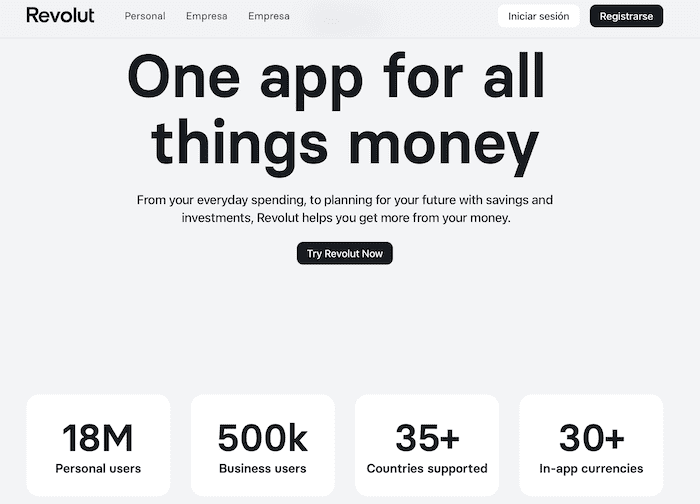

Revolut 's numbers are dizzying: 18 million users, presence in more than 35 countries and more than 150 million transactions per month. Since it was founded in 2015, this bank of British origin has not stopped growing, and offers an online account without commissions that can be very useful.

Your account and card offer many advantages , in addition to having a free version, the possibility of investing with Revolut, mobile payments, withdrawing money without commissions and operating with many currencies other than the euro at, on paper, competitive commissions.

But of course, it also has disadvantages (for example, it does not have Bizum), which is why you may be wondering if this English bank is a good option for you. To answer these questions and give you my thoughts on Revolut I have created this hyper-detailed guide.

What is Revolution?

Revolut is a British-born, London-based neobank that was launched in 2015 by Vlad Yatsenko and Nikolay Storonsky. It has more than 2,000 employees and is present in dozens of countries.

In their most basic form, they offer an online account with no fees , and a debit card to make payments and withdraw money from any ATM (a maximum of €200 per month free if you don't have a premium account).

On the other hand, it also offers a platform to buy stocks and cryptocurrencies , as well as a cashback program (refund of money for purchases) – some of these features and services are only available to paid users.

Revolut pros and cons

I detail the main advantages and disadvantages of Revolut in the following paragraphs:

Revolut Rewards

- Free : In its basic version, and if you don't ask for a physical card, Revolut is completely free.

- 100% online : Opening and operating Revolut is completely online.

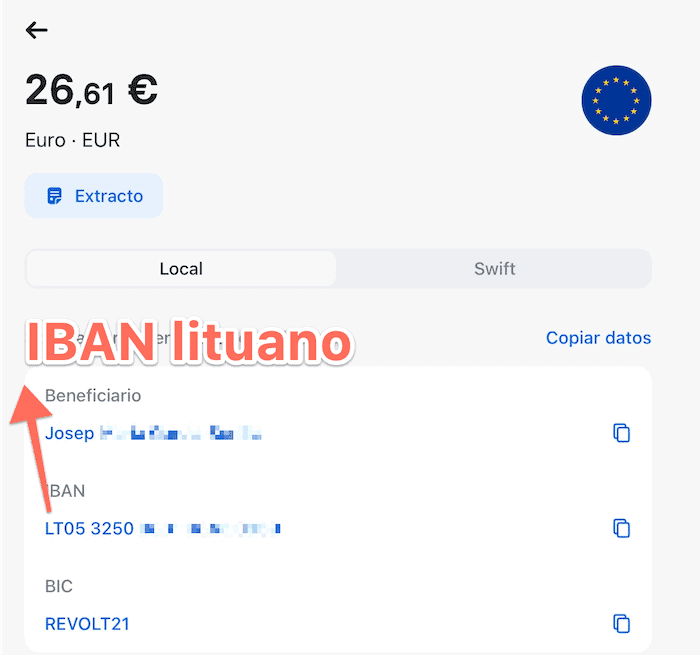

- Multiple Currencies – Revolut gives you the ability to trade and store many different currencies like Euros, Pounds, US Dollars and many more. In addition, it is possible to have an account in the United Kingdom and another with a European IBAN (from Lithuania).

- Investments : From its platform it is possible to invest in fractional shares of more than 800 global companies.

- Cryptocurrencies : With Revolut it is possible to buy cryptocurrencies easily from the Revolut app. It has more than 25, among others Bitcoin, Ethereum, XRP, Dogecoin, Litecoin, etc; more information on all this below.

- Savings spaces : Revolut lets you create spaces where you save money for your different savings goals; eg you create a small piggy bank for the holidays.

- Insurance : Payment plans include international medical insurance, and another for delayed flights and baggage.

- Cashback : If you decide on one of their payment plans (more info. below), you can receive money back for the purchases you make with your card; the program that Revolut calls rewards.

- In Spanish : Despite being a bank of English origin, its platform is fully translated and adapted to Spanish.

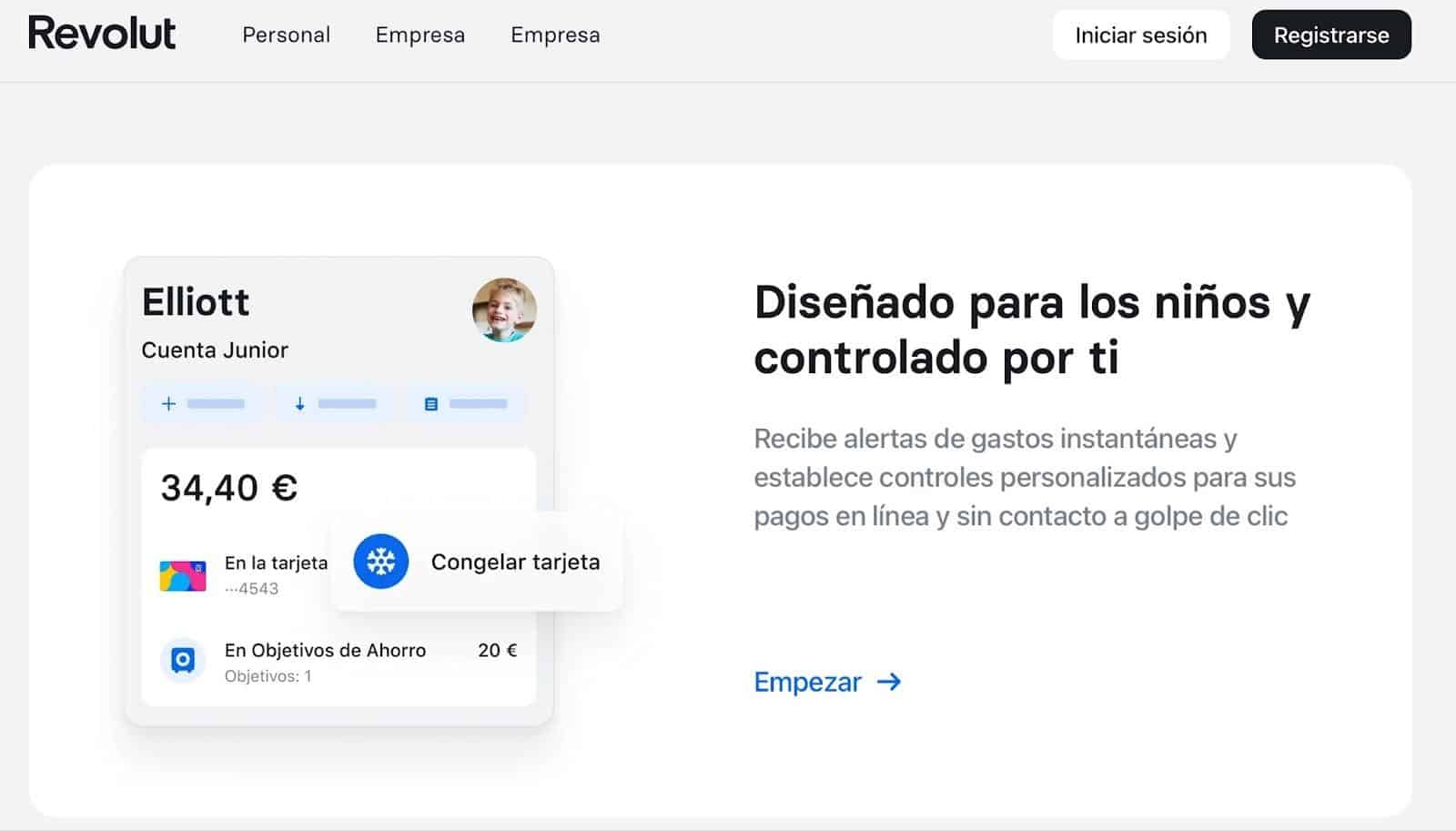

- Revolut Junior account : It is possible to link accounts for children with Revolut with which they can have money and a card that you can control.

- Deposit Guarantee Fund : Revolut (through Revolut Bank), has obtained a Lithuanian banking license, being an EU country, your money will be protected by the Lithuanian Deposit Guarantee Fund .

IBAN euro account Lithuanian Revolut

- No physical offices : Revolut is a totally online account, which is why it does not have its own offices that you can approach to be attended to in person.

- No ATM network : They also do not have their own ATM network, and therefore you will not be able to make cash deposits. Of course, it is possible to withdraw money without commissions from any ATM.

- Non-Spanish IBAN : Revolut does not have a Spanish IBAN, this can make some operations a bit more tedious. E.g. In some cases, it is only possible to do direct debit of electricity bills in accounts with a Spanish IBAN (this depends on each company).

- No agreement with the public administration : Unfortunately, from your Revolut account you will not be able to make or receive payments from the public administration. E.g. it is not possible to receive unemployment benefits, nor pay taxes or fines.

- Paid features : Revolut reserves the most interesting features and services (eg cashback or paying interest on your money) for paid users.

Who should use Revolut

Revolut is a fantastic platform/ account to complement your main account . It has a lot of advantages (eg multi-currency trading) and features that can help you organize your finances, if trading exclusively online doesn't give you vertigo.

At the moment Revolut cannot be your main account , the issue of direct debits (for example, your payroll, the gym or electricity receipt) will not always be compatible. By having only Lithuanian IBAN, it depends a lot on each company that charges you a receipt, or who sends you money (eg direct debit of the payroll).

Revolt Specifications

Here is a summary of the main features of the Revolut account.

| Criterion | Commentary |

|---|---|

Account type: Online account | Revolut is a 100% online bank that offers its users the possibility of operating in various currencies. They have commission-free accounts , and other payment accounts with certain advantages. |

Type of interest: Up to 0.65 APR | Revolut pays up to 0.65% APR for the money you have with them, but it depends a lot on the type of account you have (Standard, Plus, Premium or Metal). Few banks offer this. |

| Additional Information: Investments | In addition to a multi-currency account, Revolut offers you a platform to invest in more than 800 shares around the world, and the purchase and sale of cryptocurrencies , be aware that these investments carry risk, take a look at this guide to investing in the stock market for more information. |

| Requirements and conditions | |

Domicile payroll: Not necessary | To have a free account, you do not need to direct your salary with Revolut. Although you can do it if your company agrees to pay your salary to an account with a Lithuanian IBAN (in principle it can). |

Domicile receipts: Not necessary | Nor do you have to domicile a minimum of monthly receipts to avoid paying for using Revolut. It is possible to domicile receipts in Revolut in pounds and euros. |

Card use: Not | The Revolut card does not impose conditions of minimum use to avoid charging for maintenance. |

Addressed to: new and existing customers | Opening an account with Revolut is possible for any user, whether they are old clients of this neobank or new ones. |

| commissions | |

Maintenance: Not | In its basic version, Revolut will not charge you a maintenance fee. If you want to have access to a premium account with more benefits (eg travel insurance), you can hire a paid one. |

To take money out: €200 per month free | With the free Revolut account it is possible to withdraw money a maximum of 5 times a month and not exceed €200 per month from any ATM without paying commission. |

National transfers: Not | Transfers in euros that you make to accounts within the SEPA zone (Euro Zone) will not have commissions. |

International transfers: fitted | Revolut allows you to make international transfers in other currencies (eg pounds, dollars or Swiss francs) with very competitive prices. |

Checks: not available | Revolut does not support check trading. Take a look at Openbank if you need to write and cash checks. |

|

Other Commissions: possible | Revolut offers a lot of services such as the possibility of investing in shares, or buying cryptocurrencies, for these services you will have commissions. |

| cards | |

Credit to: Not available | Revolut does not have credit cards in its offer. He only has a prepaid card. |

Debit to: Avoidable | The Revolut card is free on paid plans. If you have a free account you have two options: 1) pay the €5 or €6 that they charge for sending the card, 2) use a virtual card with your mobile phone to make your payments. |

| Services | |

Offices and cashiers: Without own ATMs | Revolut does not have its own offices or ATMs. To make withdrawals from your account you can use other ATMs (there is a limit of money you can withdraw each month). |

Payroll advance: Not available | Revolut does not have this service. |

overall rating 4.4 out of 5 | Opening a Revolut account can be a good option if you want an online bank that works well, and does not put conditions on you to open an account. It has other services such as investments or savings spaces that are "an extra". As it does not have its own ATM network, operating in cash is not possible and this can be a setback for some. |

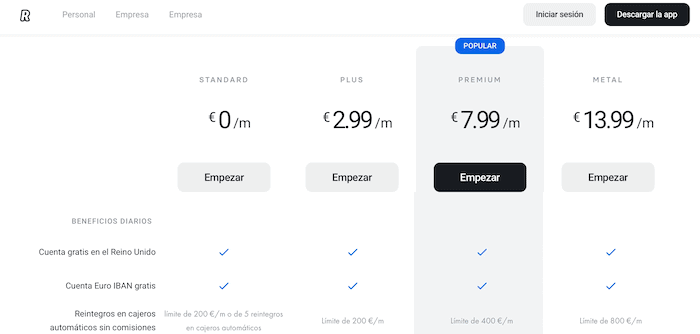

Revolut Standard vs Plus, vs Premium vs Metal

As I have briefly mentioned, Revolut has several account types that you can use. They go from the completely free account (Standard) to the metal account that costs almost €14 per month.

Revolut Plans and Accounts

Let me tell you what each offers:

| Revolut Advantages | Standard | Pro | Premium | Metal |

|---|---|---|---|---|

| monthly fee | €0 | €2.99 | €7.99 | €13.99 |

| UK and Europe (Lithuania) account | Yes | Yes | Yes | Yes |

| Physical Revolut Card | €6 (1 time only) | Free | Free (Exclusive designs) | Free (metal card) |

| Virtual Revolut card (mobile payment) | Yes | Yes | Yes | Yes |

| Free monthly withdrawals | €200 / month (max. 5 times) | €200 / month | €400 / month | €800 / month |

| Interest on your money | Up to 0.15% APR | Up to 0.3% APR | Up to 0.65% APR | Up to 0.65% APR |

| Revolut Junior Accounts | 1 child | 2 children | 2 children | 5 children |

| Protection of purchases, tickets and returns * | Not | Up to £1,000 a year | Up to £2,500 a year | Up to £10,000 a year |

| Priority customer service | Not | Yes | Yes | Yes |

| Medical and travel delay insurance | Not | Not | Yes | Yes |

| Cashback (0.1% in Europe, 1% outside of Europe) | Not | Not | Not | Yes |

| More information | revolut.com | |||

* This is insurance against theft, accident for purchases for personal use that you have made with the Revolut card.

Revolut Standard : It is the account for those who do not want to pay a penny for having an online account without conditions.

Revolut Pro : If you want to have priority customer service, receive more interest on your money and insurance for your purchases you make with your prepaid card.

Revolut Premium : Being able to enjoy medical and travel delay insurance is the main advantage of this type of Revolut account.

Revolut Metal : In addition to having a metal Revolut card, Revolut will give you money back from the accounts you make with your card.

Revolut Premium Services

Above I have mentioned some of the premium services that Revolut offers to its account and prepaid card users. But let me give you more details of its payment benefits.

cash back

Undoubtedly one of the most interesting advantages, because few cards in Spain (and Europe) give you money back for all your purchases. In the case of Revolut, if you decide to upgrade your account and contract the most expensive plan (about €14 per month), they will return 0.1% of all your purchases in Europe , and 1% of those you make outside of Europe.

In this case, the account will cost you almost €168 per year (€13.99 * 12 months), this means that you will have to spend (if within Europe) 170 thousand euros per year with the card to offset this annual fee. ; keep in mind that this plan has many more advantages, it may not compensate you for cashback, but others do.

Of course, if you are outside of Europe, and you use Revolut regularly, you will need to spend the equivalent of €17,000 (in another currency, since you will be outside of Europe) with your card so that it pays off.

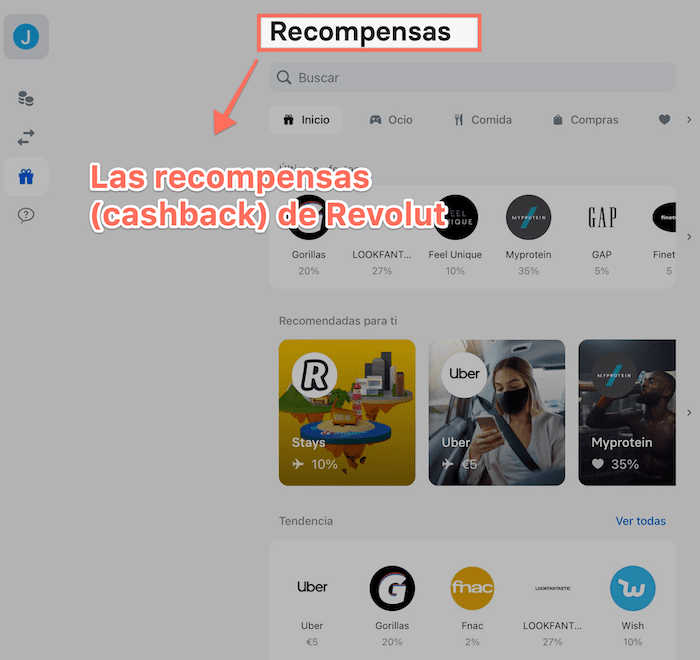

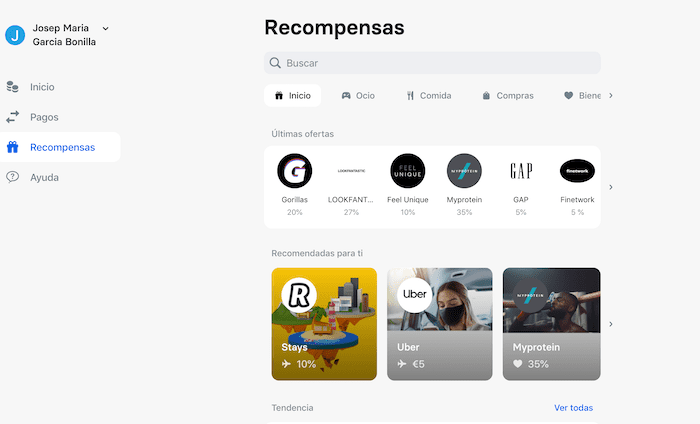

rewards

The Revolut cashback may not compensate you, they offer a very low % for the purchases you make with the card and it will be difficult for you to spend that much money.

But Revolut has agreements with certain brands and companies for which you will have greater discounts , or they will give you money back if you use their card when paying.

free special cards

The truth is that for me this is not a big what, but the truth is that Revolut offers its paying customers the possibility of requesting cards that are aesthetically somewhat different . For example, with the most expensive plan you will have the right to have a metallic card; their virtual card works just as well.

It is true that if you do not want to use your phone to physically pay with a virtual card (Google Pay or Apple Pay), with the payment plans they will send you one without shipping costs (in the free Revolut account you will have to pay €6 for shipping costs).

Interest on your money

Revolut pays some interest on the money you have with them , not a lot, but it's a stone's worth. The good thing is that with your free account, you already have some interest ( 0.15% APR ), but if you improve the account you will have a higher %. For example, the first payment plan gives you double ( 0.30% APR ), while Premium and Metal offer you 0.65% APR .

Example of profitability with Revolut

For example, if we were users of the Premium plan and we decided to have €15,000 in your account, and Revolut continues to offer 0.65%, we would receive interest of almost €100 after 12 months, that alone already pays for the Revolut Premium plan (about €96 per year)

Investments

I'm not going to go too far here, but Revolut is also an online broker , and it allows its users to invest in some stocks (about 800 different companies), buy a dozen cryptocurrencies like Bitcoin or Ethereum, and raw materials ( invest in gold and silver ).

Well, if this is something that catches your attention and you are going to invest in the stock market or cryptos using Revolut, it is still worth using one of their payment plans, since they charge lower commissions for this type of operation if you are a Premium customer or Metal.

Priority customer service

The truth is, Revolut customer support doesn't always get the best reviews ; some users complain that there is a long wait to contact Revolut via their chat or phone (UK number).

If you contract a payment plan with Revolut (they start at €3), you will have priority attention from their support team, 24 hours a day.

Revolut Insurance

The Standard, Premium and Metal accounts come with insurance linked to the purchases you make with the card, product returns you want to make, and tickets you buy with the card.

Finally, the Revolut Premium and Metal payment plans have international medical insurance (in case something happens to you on a trip), and one for delays and loss of flights and luggage.

If you want to actively use these insurances that Revolut offers, please take a look at the conditions to understand what coverage and requirements they have, I am not an insurance expert.

The Revolut account

One of the advantages of Revolut is that it is a platform that allows you to have two accounts, one in euros (with Lithuanian IBAN), and another in pounds. Both accounts have different numbers and allow you to operate by making transfers, receiving money or direct debiting receipts. This is very practical if you trade in euros and pounds . For example, if you have clients in Europe and the United Kingdom.

Revolut Vaults Example

I will tell you about some of the particularities of Revolut:

- Adding Funds : It is only possible to add money to your Revolut account by bank transfer (yours or someone else's), credit or debit card, or payments from another Revolut account. This means that making cash deposits is not possible (since it does not have its own ATMs).

- Withdraw money : With Revolut you can withdraw money from any ATM up to 5 times a month for free, and without exceeding €200 per month. If you need more flexibility, you will have to sign up for a paid account.

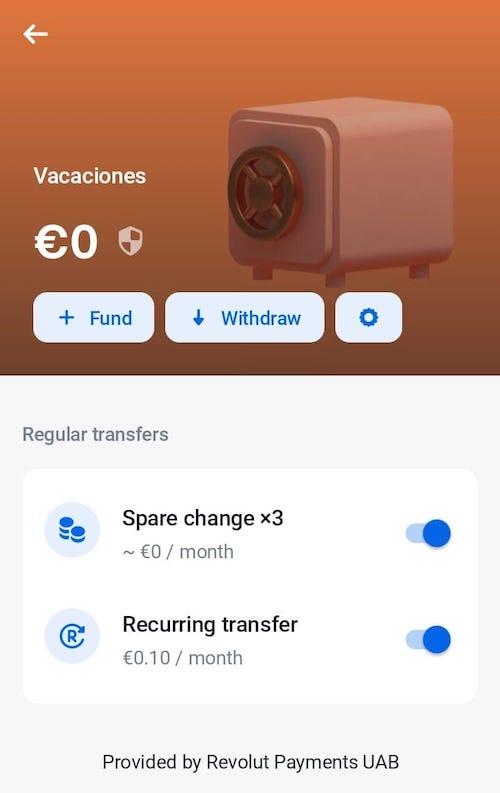

- Savings spaces : Revolut, within its platform, allows you to create your spaces in your account (you can even choose in which currency) so that you set aside money to manage your finances. For example, if you want, you can create a space (they call it Revolut Vaults) to save money for the holidays where you add money little by little. In addition, this space can be individual or group (eg with your friends or partner).

- Expense analysis : If you're interested, Revolut's system has a function whereby it categorizes all your expenses and income and allows you to see where your money is 'going'. This can be a very good help to understand your finances better and optimize savings.

- Currencies : With Revolut you can have spaces in dozens of different currencies such as American, Australian, Canadian dollars, euros, pounds, Swiss francs, Mexican pesos or Danish crowns among others.

Revolut cards

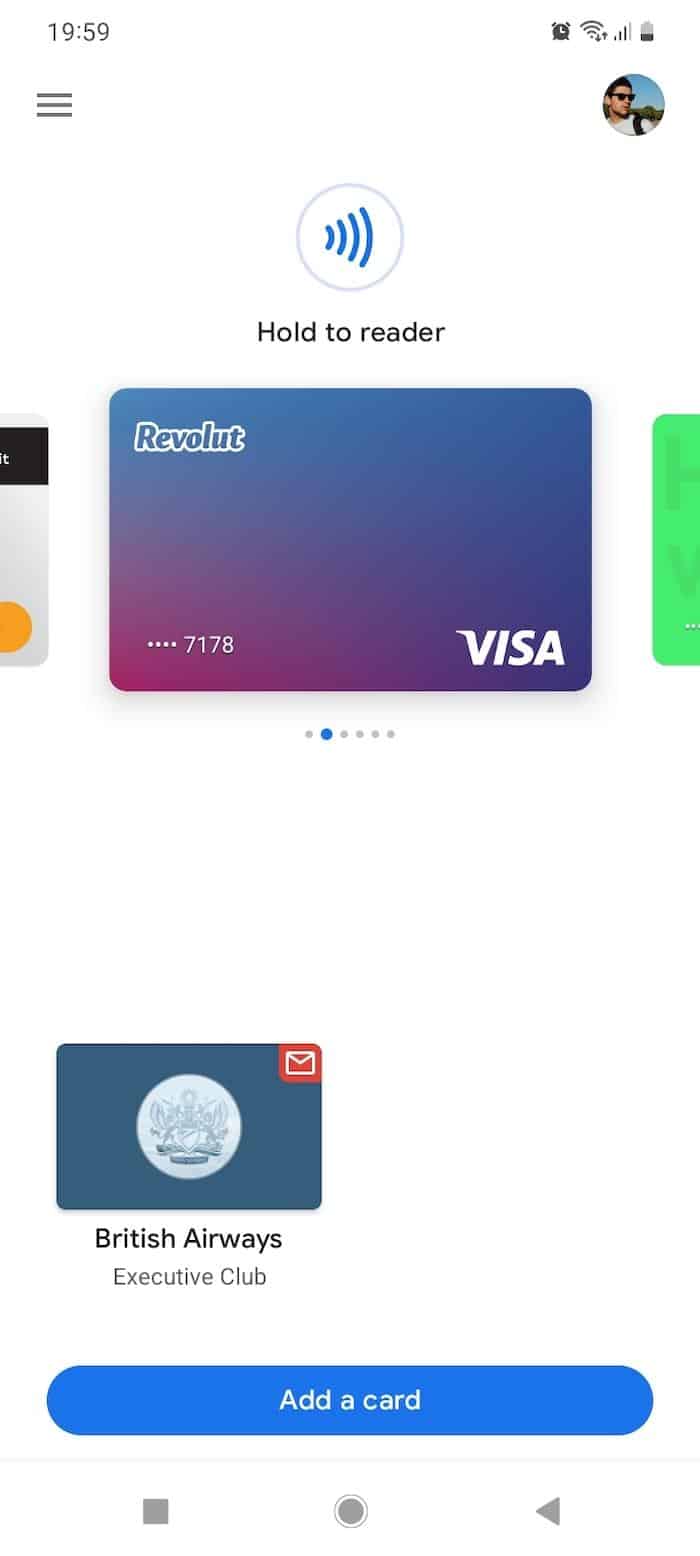

Revolut comes with the ability to have a debit (Visa) card attached to your account. If you decide for the free plan you can use a virtual card to pay with your mobile (using Google or Apple Pay), if you prefer to have a physical card you will have to pay €6 for shipping costs.

Mobile payments with the Revolut card

As I have mentioned before, the Revolut payment plans will send you a physical card totally free .

Let me tell you about some peculiarities of the Revolut target:

- Security : The Revolut app allows you to customize the use of the card. For example, you can 'freeze' it if you're not going to use it, change the pin, or set limits on monthly spending with the card.

- Payments abroad : This bank account without commissions allows you to make payments abroad and in other currencies at competitive prices (the exchange rate depends on the currencies).

- Credit card : After doing a solvency study, Revolut may grant you a credit card (limit 2 times your salary). Keep in mind, therefore, that credit cards can have a high interest.

- Disposable card : Revolut allows you to have a card to make online purchases where the numbers, expiration dates, and security codes are updated each time you make an online purchase for greater security.

- Request more cards : If for any reason you need to have more than one card, you can request virtual cards (for mobile payments) in seconds.

Frequently Asked Questions about Revolut

The following frequently asked questions about Revolut may answer a quick question that has arisen.

What country is Revolut from?

Revolut is originally from the United Kingdom , although its founders (Nik Storonsky and Vlad Yatsenko) are not English; They are from Russia and Ukraine respectively. Of course, it is possible to use Revolut in Spain (and thirty other countries) without any problem.

Is Revolut Safe?

Revolut is a financial entity that has been operating in Europe for several years now , it was one of the first neobanks (in the sector called fintech) to be launched.

On the other hand, it has several banking licenses , so it is audited by various financial control bodies (eg , the UK Financial Conduct Authority) . But even more interesting, for European users, it turns out that they have a banking license in Lithuania , so being a member country of the European Union, all the deposits you have up to €100,000 are insured by its central bank.

What is Revolut used for?

Revolut is a platform to manage your money. In addition to being a checking account in which to have receipts and payments domiciled, and making a prepaid card available, Revolut offers many other financial services such as investments , accounts for minors associated with your account or payment installments .

Is Revolut a bank?

Revolut Spain was an electronic payment company (something similar to PayPal), but since 2022 they have obtained a banking license in Lithuania and Revolut Bank is a European bank ; this makes their deposits covered by the deposit guarantee fund (of Lithuania).

Is my money secured with Revolut?

As it is an authorized bank based in the European Union (Lithuania), any European client (Spanish ones too) will have up to €100,000 insured if Revolut goes bankrupt. In theory, in 10 days you should have your money back.

Does Revolut have a Spanish IBAN?

Not at the moment, Revolut does not have a Spanish IBAN . Yes, you will have an account with an IBAN from the European Union (Lithuania), and an account number from the United Kingdom.

In these accounts it is possible to direct debit receipts and payments, but the truth is that some companies (eg water company) do not allow direct debit of receipts in accounts that do not have a Spanish IBAN; ask before using Revolut for your direct debits.

Can I use Revolut on my mobile?

Yes, using Revolut on your Android phone or iPhone is not a problem. You can even link your Revolut card (physical or virtual) with Apple and Google Pay. In fact, if you don't have a mobile phone you won't be able to use Revolut as they won't let you open an account with them.

What is Revolut Junior?

This is a child account type for Revolut users to link to (and control) their Revolut account.

These Revolut Junior accounts are available even for users in the free mode (max. 1 child per free user, if you need more you will have to have a paid Revolut plan).

Can I direct debit income and receipts with Revolut?

Direct deposit of bills in euros or pounds (eg phone, gym and so on) is possible with Revolut . Keep in mind that your account in euros will have a Lithuanian (not Spanish) IBAN, some companies may not allow you to direct debit payments with an account with a non-Spanish IBAN.

On the other hand, you have to know that Revolut does not collaborate with the public administration , which is why it is not possible to direct debit payments from public entities (eg your self-employed fee, the IBI or the circulation tax). You will also not be able to receive payments from public institutions (eg unemployment or a pension).

Is Revolut connected to the IRS?

As I told you in the previous question, Revolut is not directly connected with the public administration to make payments and collections. Keep in mind that it is a European bank, so it obeys European regulations (eg, on money laundering).

What conditions does Revolut have?

Other than being of legal age and residing in one of the countries where Revolut Bank operates, there are no other requirements to open an account.

How can I contact Revolut?

Well, it's quite easy to communicate with Revolut through the application's chat, in my experience they always answered me quickly, although sometimes you have to wait. On the other hand, there is a telephone line (+ 37052143608) that you can call in case of emergency (eg to block the card), keep in mind that they will not answer you by phone, it is only for emergencies .

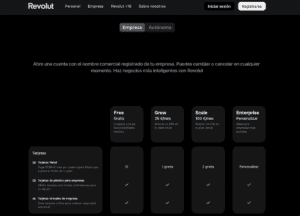

Does Revolut offer business accounts?

Yes, and it works quite well. If you have a company, for example a Limited Company, you will be able to open an account with Revolut in a couple of days. Your Revolut Business account, similar to your personal account, offers several account types : Free, Grow, Scale and Enterprise.

The truth is that it is a very good account, with which you will have the possibility of operating in several currencies with advantageous conditions, you will be able to have a debit card and even accept payments online through Revolut. In addition, the Revolut system allows you to create sub-accounts and connect and disconnect them to certain cards, all very flexible.

Of course, you have to take into account that it is not ideal as an account to operate with the public administration ; paying receipts and domiciling collections and payments from the Tax Agency is not possible.

Can I make cash deposits into Revolut?

No, at the moment it is not possible to make cash deposits with Revolut, this is an option that may discourage many. And I bring you another limitation, it is not possible to make deposits with checks through Revolut.

If you want an online account that allows you to deposit with checks or cash, you can take a look at one of these alternatives Wise .

How long does Revolut take to send the money?

If you send money to another Revolut account , this transfer will be immediate . If you make (or receive) a bank transfer within SEPA ( Single Euro Payment Area ), the waiting time will be one business day. In the case of international transfers, for example, from Spain to the United States, it can take 3 to 5 business days.

For the deposits you want to make to your Revolut account, the time in which you will have the money available varies depending on the payment method you use. For example, if you use a card or your mobile to add funds, these will be available immediately. In the case of making a bank transfer, you will have to wait for it to become effective (between 1 and 2 business days for transfers within SEPA).

Revolut ensures that 63% of its transfers arrive in less than an hour , and another 15% arrive the next day. This means that 78% of transfers reach their destination, at most, the next day.

What alternatives does Revolut have?

It is possible that for some reason Revolut does not end up fitting you as one of the online banks with which you want to open your accounts without commissions . If so, here are some alternatives to Revolut for you to choose from.

N26

With more than 7 million customers , this bank from Germany has an account (with a Spanish IBAN) with which you can operate and use as your main account. You can domicile receipts, and payments such as your payroll if you wish; does not impose conditions for your account with them to be free. Although you can withdraw money from any ATM (limited number of times per month), it is not the best option if you want to operate with cash (eg make deposits).

Unlike most online banks (neobank type) such as Revolut or Wise, N26 will allow you to connect your account to Bizum . If this service is a must for you, surely N26 is a better alternative than Revolut.

openbank

If you are looking for a more local bank, with which to operate and have its own ATM network , but at the same time fully managed remotely (with its mobile app or through the website), you can take a look at Openbank . This bank is part of the Santander Group, one of the largest in the world. Nor does it require conditions for the account to be free, the main disadvantage compared to Revolut is that operating in currencies other than the euro is not so cheap.

> Visit Openbank and open an account

BBVA Online

If you want an alternative to Revolut with a Spanish IBAN and its own branch and ATM network , you can value BBVA and its online account. This checking account does not require any link to avoid charging for the card, nor for the administration or maintenance of the account. Being an unlinked account, it has some limitations, such as having a stub to write checks.

> Visit BBVA and open an account

Revolut Opinions: Final Thoughts

I hope that after this guide to the Revolut platform and services you will have a clearer understanding of what this bank of British origin offers, and if its account and its investment platform is a good alternative for you.

Of course, if you decide on Revolut, I want to remind you that some of its most advanced features and advantages are reserved for paid users . It is also not a good option if you want an account with more than one owner (take a look at BBVA or Openbank for this).

But of course, its advantages can be very interesting for many (eg trading currencies at good prices), and the fact that they do not impose conditions for not charging commissions is good news.

Of course, if you have any questions or want to share your experience and (respectful) opinion about Revolut, please leave a comment, I'll be happy to read it.

Thank you so much for this articles they do have very clear and informative details

ReplyDeleteVery interesting and informative article. This is very helpful

ReplyDeleteThis is a very informative article, its well explained and simple to understand by all. Its encouraging to learn from this piece.

ReplyDelete