What is Block Earner (BLRN)?

Block Earner is an Australian-based FinTech company powered by blockchain technology. The project provides access to DeFi (Decentralized Finance) products that were previously only available to tech-savvy investors.

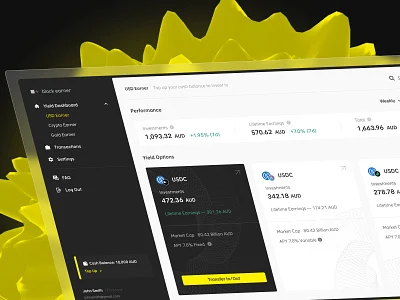

Block Earner offers a high yield account that allows you to earn higher returns than traditional financial alternatives. You can choose between a variable fixed percentage return of 7% or 2-18% annually with Block Earner.

Highlights of Block Earner (BLRN) project

Block Earner solves the heavy lifting by providing a user-friendly portal to earn higher profits. This is facilitated with industry-leading security, to make decentralized finance a more inclusive space for all.

- How does Block Earner make a 7% fixed return?

Block Earner's 7% fixed return option offers daily compounded fixed return with no lock-up period. Your Australian dollar deposits into the Fixed Yield option will be automatically converted to USD (USDC) and loaned to Block Earner in return for a steady 7% annual rate of return.

- How does Block Earner make variable profits?

Block Earner facilitates access to leading profit platforms – Aave and Compound, connecting borrowers and lenders in the decentralized finance sector. Your deposits are lent to borrowers, who pay an annual interest on the borrowed amount.

Aave and Compound are smart contract lending systems , open source, decentralized and non-custodial. Borrowers in this system are required to provide digital assets much larger than the amount borrowed as collateral.

- What are the benefits of Block Earner profit account?

Block Earner makes the future of finance accessible to everyone, providing industry-leading security so clients can access top profit platforms in decentralized finance. .

Simply deposit AUD and choose the profit platform you want to join. Choose between a 7% fixed rate or a variable annualized yield of 2-18%. At Block Earner you can deposit or withdraw at any time to your designated Bank Account.

- How is fixed income generated?

Deposit to Block Earner 7% fixed option, which automatically converts your Australian dollars into USD-backed stablecoins (USDC) through our exchange services and these stablecoins will then be given away. we borrow. Block Earner offers high risk-adjusted returns by working exclusively with partners with proven, sustainable and measured investment strategies.

Block Earner can generate profits by pooling client funds and lending to our trusted partners, who are all checked against our risk policy, thus receiving profitable rate of return.

- How is variable output generated?

Block Earner's variable yield options facilitate the direct purchase of USD carry (USDC) yield. These USD are held in Aave and Compound, two of the leading decentralized finance (DeFi) blockchain protocols. Aave and Compound are smart contract, open source, decentralized and unattended lending systems that are regularly tested and regulated.

In exchange for deposits in Aave and Compound you will earn between 2-18% variable annual return. Profits are generated by connecting borrowers and lenders using these protocols. Your deposits into these platforms are lent to borrowers, who pay annual interest on the borrowed funds.

- What factors determine variable productivity?

Variable yields are determined by market supply and demand, and variable rates can change frequently due to a variety of factors.

- Can profit margins change?

The rate of return changes daily.

A fixed rate of return paid to users in exchange for those users for eligible crypto users for Block Earners will be calculated by the block earners and published on the Platform. earn block coins. Block Earner reserves the right to change the interest rate paid monthly, with the new interest effective on the first calendar day of each month. Block Earner will provide seven (7) calendar days written notice of any such change, which will be released on the Block Earner platform [and sent to the email address you used to post sign my Block Earner account]. By continuing to join Lend on the first [calendar day] of each month, you agree to the new interest rate announced by Block Earner.

- Does Block Earner have a fee?

Block Earner has no hidden fees and transfers earnings from profits directly to our clients.

We have two types of fees:

Our clients can withdraw $100 AUD or more anytime for free. We charge a flat fee of $1.00 for AUD withdrawals if the amount is less than $100.

We have exchange rate spread from AUD to USDC and USDC to AUD. The exchange rate fluctuates due to the AUD/USD forex market. We lock competitive exchange rates for our customers on AUD/USDC conversions and provide estimated exchange rates for USDC/AUD conversions. These rates include spreads.

Block Earner is powered by leading blockchain profit platforms Aave and Compound, these platforms are audited regularly and all audits are publicly available. Block Earner also works exclusively with a USD-backed “stablecoin” known as USDC, USDC is a regulated and regularly audited digital stablecoin pegged 1:1 to the US Dollar.

Block Earner is registered with AUSTRAC as an independent Digital Currency Exchange and Remittance provider and has partnered with Fireblocks, the industry's largest institutional digital asset security tool. trusted to protect billions of dollars.

What is Block Earner Token ($BLRN)?

BLRN is expected to be the native token of the Block Earner project.

TOKEN DISTRIBUTION

(Updating)

Roadmap of Block Earner project (BLRN Coin)

(Updating)

Team of Block Earner (BLRN Coin)

- Charlie Karaboga – Co-Founder, CEO

- Jordan Momtazi – Co-Founder

- Apurva Chiranewala – General Manager

- Baris Yilmaz – Head of Finance

- Colin Williamson – Head of Digital & Growth

- Martin Jones – Head of Engineering

- Nicholas Brooking – Head of Product

- Tawanda Mangere – Head of Risk & Compliance

- Dylan Murray – Project Director

- Lina Lukosiunaite – Director of CRM

- Oscar Panaretto – Brand Expert

- Justin Wu – UI & UX

- Veronika Chalasova – Office administrator

- Oleksandr Kobyliatskyi – Software Engineer

- Anton Rey – Software Engineer

- Yuliia Yezovskikh – Software Engineer

- Sergey Turchak – Software Engineer

- Anna Shypilova – Software Engineer

- Dmitry Volontyr – Software Engineer

- Sonam Serchan – Software Engineer

- Ivana Jones – QA Engineer

- Kirill Kuznetsov – QA Engineer

- Carissa Evangelista – Support Representative

- Jim Ji – Support Representative

Advisor of the Block Earner project (BLRN Coin)

(Updating)

Block Earner project partner and investor

PROJECT PARTNER BLOCK EARNER

(Updating)

INVESTORS OF THE BLOCK EARNER . PROJECT

US VC firm Framework Ventures led a $6.4 million seed round, with participation from Coinbase

, DeFi Alliance, and Longhash Ventures.Is Block Earner Token worth the investment?

Over the past year, those yields have ranged from 2% to 18%, depending on the supply of stablecoins committed to protocols and borrowing needs.

“ In traditional finance, the central banks decide these rates. In decentralized finance, the market decides, ” said Mr. Karaboga.

Block Earner claims it is the first fintech in the world to offer a direct connection to Aave and Compound, to which the lenders have committed $18 billion. They run on the Ethereum blockchain and use “smart contracts” that set the rules for borrowing and lending.

Borrowers operate on the core principle of over-collateralisation: smart contracts that automatically return principal and interest to the lender if the value of the borrower's collateral (assets other cryptocurrencies) lower than the predefined trigger level.

Thus, borrowers are incentivized to top up the collateral, or lose it. If the smart contract works as planned, then the lender should always be repaid.

Decentralized finance allows loans to be made anonymously, without credit or “know your customer” (KYC) checks. This is a different model from banks using human credit teams supervised by legal rules to insure the risk of “fractional reserve banks” (long-term loans with deposits). short term) does not cause a financial crisis.

Also check their review on Trustplot Actually 4.6 stars

.jpg)

.jpg)

.jpg)

.jpg)

Leave a review